In this blog post, we will talk about ways we can unlock success with this 12-month financial checklist we wrote out for you, below. As we embark on a new year, it’s time to level up our financial game.

Managing family finances can often feel like a juggling act, but it doesn’t have to be. By checking in with your finances monthly, you can spread out updating all elements of your financial obligations, making it so much more manageable.

Unlock Success With This 12-Month Financial Checklist

Canva Pro

Let’s talk about the smart money moves you can take each month of the year and unlock success with this 12-month financial checklist:

Financial Things To Do In January

Reflect and set goals for this year: Reflect on your financial journey over the past year. Celebrate your wins, learn from your challenges, and embrace your financial story. Think about what you want to accomplish financially this year and what it will take to achieve it.

Update your budget: January is the perfect time to review and update your budget for the year to come. Embrace any changes in your income or expenses and allocate your funds wisely to align with your financial priorities.

Review retirement investments: Take a look at your retirement accounts to see the progress you’ve made so far. Rebalance your portfolio to align with a risk tolerance that makes the most sense for you.

Financial Things To Do In February

Review your credit score: February is the month of love, and your credit score deserves some affection too! Get a copy of your credit report and review it from top to bottom to spot any inaccuracies.

Make a plan to pay down holiday debt: Take a moment to visualize conquering all of your debt from the holiday season. List it out, prioritize, and pay off those high-interest debts first.

Get organized for tax season: With tax season just around the corner, take some time in February to gather those essential tax documents. Prepare using tax software or work with a professional to make sure you file correctly and maximize your deductions.

Financial Things To Do In March

Declutter and organize your finances: March is the perfect month to do some financial spring cleaning. Declutter those financial documents, organize hard copies in labeled folders, and digitize what you can to reduce your paper clutter.

Try a money-saving challenge: Saving doesn’t have to be boring—challenge yourself with a financial game to make things a little more interesting.

Use budgeting apps to track your spending, and think of different ways to celebrate your milestones that won’t undo all the progress you’ve made!

Canva Pro

Financial Things To Do In April

File your taxes on time: April showers bring May flowers, and timely tax filing brings financial blooms! Make sure you know when taxes are due, and work to get your taxes filed before the deadline. Filing electronically typically speeds up the process.

Make some home improvements: Think of some budget-friendly home projects that will add value to your home. With how many videos and resources are available, you can easily find a DIY project within your skill set and budget that will make a huge difference in your home.

Plan your summer trips: Get ahead on your summer travel plans so you can plan like a pro and give yourself enough time to properly save up. Look for travel deals and discounts for your trip and create a vacation budget for a stress-free escape.

Financial Things To Do In May

Save for education: Sow the seeds for your children’s education with a college savings plan or other savings accounts. Explore the tax benefits of different account types and understand your financial aid options. Now is the perfect time to start cultivating a garden of educational dreams for your little ones.

Teach your kids about money: Imparting financial wisdom to your kids is one of the best ways you can prepare them for financial independence. Introduce them to budgeting and include them in your family’s finances in an age-appropriate way.

Brush up on your own money skills: And speaking of financial wisdom—now’s a good time to sharpen your own money skills so you can make better financial decisions for your family. Explore webinars, listen to podcasts, and read articles to expand your financial knowledge.

Financial Things To Do In June

Check-in with your goals and budget: Give yourself a mid-year financial review. Assess the goals you set at the beginning of the year, celebrate your victories, and make adjustments to help you get back on track toward derailed goals.

Canva Pro

Financial Things To Do In July

Start saving for holiday spending: Begin building a savings fund specifically for your holiday expenses to avoid stress from those last-minute purchases. Create a separate account or keep cash in an envelope to ensure you can save enough for the holiday season.

Plan for winter travel: Just as you planned for your summer travel a few months ago, it’s time to start thinking about your winter travel plans. Start your research and booking early to get better deals, and adjust your budget accordingly.

Financial Things To Do In August

Back-to-school shopping: Gear up for your back-to-school shopping sprees with a clear budget in hand. Review classroom lists and prioritize the essentials first. Be on the lookout for seasonal sales to make the most of your budget.

Review your subscriptions: With the kiddos back to school, you may not need all your streaming services or memberships. Take inventory of your subscriptions and cut any that you no longer need.

Financial Things To Do In September

Review your health benefits: Understand when your open enrollment periods for insurance are and take the time to review your health insurance options.

Take advantage of flexible spending accounts (FSAs) or health savings accounts (HSAs) if these are available to you to enjoy some special tax advantages.

Update your estate plan: Before the rush of the holiday season begins, take some time to update your estate plans. Review your will, powers of attorney, and trusts—or create these documents if you haven’t already done so. An updated estate plan solidifies your legacy and protects your family’s financial future.

Financial Things To Do In October

Review your savings accounts: Take a look at your emergency fund and ensure you still have enough saved up to cover your current living expenses for at least a few months. If your situation has changed or you had to dip into it, make any adjustments to your budget to help you replenish it.

Review insurance coverage: In October, evaluate your life insurance coverage and make sure to update your beneficiaries.

If you’ve had any life changes, like adding a new member to the family or buying a bigger house, consider whether or not the coverage you have now is enough to cover your family’s financial needs.

If you don’t have life insurance, now is a good time to consider your needs. The younger and healthier you are when you get a policy, the more affordable it tends to be.

Get quotes from multiple providers to lock in the best rate for your desired coverage. Look for no-exam insurance policies to streamline your application process and get covered quickly.

Canva Pro

Financial Things To Do In November

Use up health insurance benefits: Before your health insurance benefits expire, schedule any necessary appointments and take advantage of preventative services covered by your insurance.

Scope seasonal discounts: Plan purchases for the holiday season strategically around special deals and promos. Black Friday and Cyber Monday are your friends! Create a realistic holiday budget to guide your spending for the season.

Financial Things To Do In December

Donate to charity: Celebrate the joy of charitable giving. Review your plan, make year-end donations, and spread financial cheer. Keep track of your donations up until the end of the tax year in case you qualify for any deductions.

Take advantage of pretax contributions: Maximize any of your pretax contributions to your retirement accounts and take advantage of any employer-sponsored benefits before the year’s end.

By the end of your year-long financial adventure, you will have taken all the steps necessary to provide a more secure financial future.

Managing your finances isn’t a one-and-done thing—you need to regularly check in and pace yourself throughout the year.

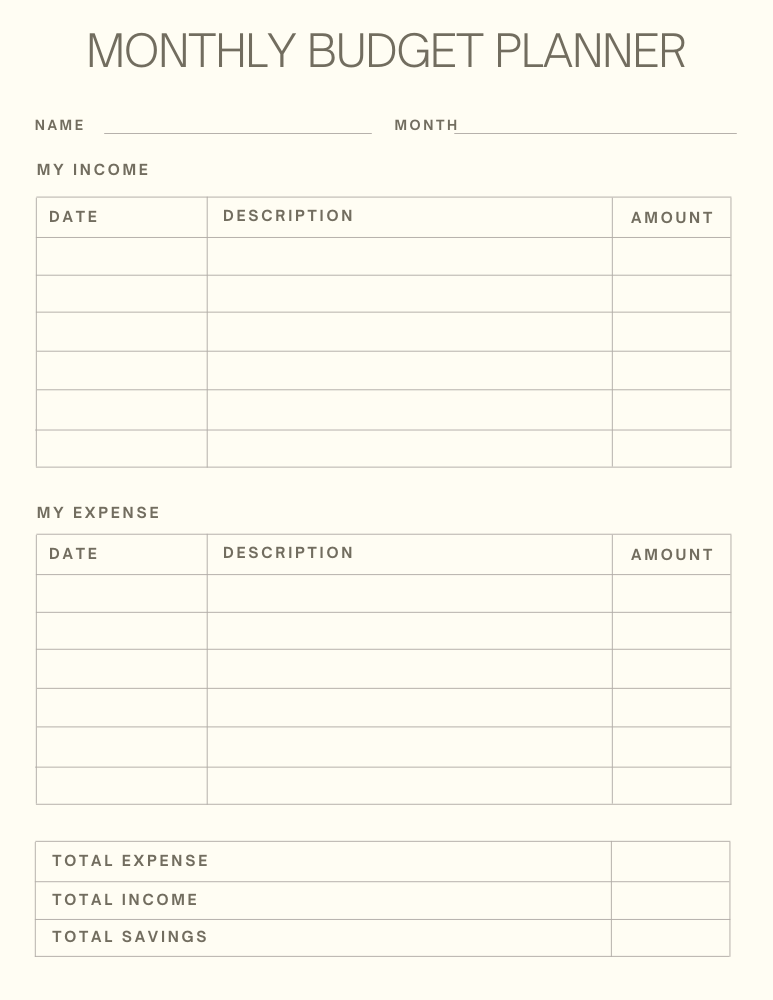

This year and beyond, make it a habit to keep tabs on not only your finances but how much you are spending too. Always keep a budget sheet or a financial planner for this purpose. Hopefully, you can now Unlock Success With This 12-Month Financial Checklist you see above.

Grab These Free Printables To Help You Manage Your Finances

Below are some free printables I created to help you manage your yearly finances and help you budget each month so you succeed!

Printable Monthly Planner Budget Sheet: Click the link OR image below to download and print it out!

Free Monthly Expense Tracker: Click that link or click the picture below to download and print the monthly expense tracker!