In this post, we provide a helpful tax payments calculator. When it comes to paying your taxes, being a fashion designer who works for themselves has particular difficulties. Self-employed people are in charge of tracking their income and filing their taxes, as opposed to regular workers who have taxes deducted from their paychecks.

In this post, we’ll go through the tax repercussions for independent fashion designers, including the 1099 tax rate, projected tax payments, and how to compute self-employment tax.

1099 Tax Percentage

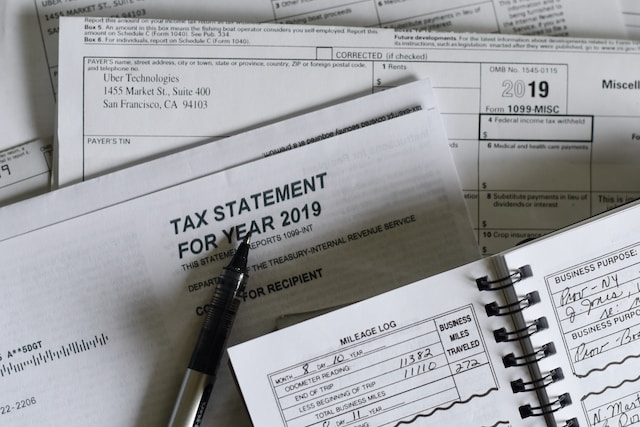

Any customer or company from whom you made more than $600 in a tax year will send you a Form 1099-MISC if you are a self-employed person.

The entire amount you have been paid by the customer is shown on this form, which is forwarded to the IRS. It also details any costs the customer paid on your behalf.

This revenue qualifies as self-employment income. Depending on your income level, the current single tax rate ranges from 10% to 37%.

You must pay the self-employment tax if your net self-employment income is higher than $400. This tax is a fusion of the Social Security and Medicare levies.

The current Social Security tax rate is 12.4% on the first $142,800 of your income, and the current Medicare tax rate is 2.9% on all of your self-employment income. A further 0.9% Medicare tax must be paid if your annual income as a single filer exceeds $200,000.

Calculator for Estimated Tax Payments for 2023

Managing their financial flow is one of the main difficulties independent fashion designers confront. It might be challenging to forecast your earnings without a monthly salary.

You must also make projected tax payments every quarter throughout the whole year since you are responsible for paying your taxes.

You can calculate how much you’ll owe in taxes each quarter with the IRS’s quarterly tax payments 2023 calculator. To utilize this tool, you must estimate your annual income total, taking into account any dividends, interest, and self-employment revenue. Additionally, you’ll need to estimate any deductions you’ll be able to claim, such as those for company costs.

The calculator will calculate an approximate amount for your quarterly projected tax payments when you provide this information.

Maximizing Tax Savings

As a self-employed fashion designer, it’s crucial to optimize your tax savings since you are accountable for paying your taxes. Here are a few strategies to consider:

1. Monitor your business expenses

Your taxable income may be reduced by any business-related costs. This may include items like supplies, machinery, and office space. You may optimize your tax deductions by keeping track of these costs throughout the year.

2. Pay into a retirement plan

You may reduce your taxable income by making contributions to retirement plans like a regular IRA or a single 401(k). You’ll not only be putting money away for the future, but you’ll also be paying less in taxes right now.

3. Use a tax expert

Being a self-employed fashion designer and doing your taxes may be challenging, particularly if you’re not acquainted with the tax law.

To assist you in navigating the procedure, think about employing a tax specialist. They can guarantee you’re paying the correct anticipated tax payments, assist you find deductions you may be overlooking, and provide insightful recommendations for optimizing your tax savings.

How to Calculate Self-Employment Tax

You must figure out your self-employment tax each year if you are a self-employed fashion designer. Form 1040-ES, which is used to pay estimated taxes throughout the year, may be used for this.

You must ascertain your net self-employment income to compute your self-employment tax. This is your entire revenue from your company, less any business-related costs, and deductions. You must multiply this sum by the self-employment tax rate of 15.3% once you have determined it.

Say, for instance, that in 2022 you made $100,000 through self-employment. Your net self-employment income is $80,000 after company expenditures and deductions. This sum multiplied by 15.3% gives you a self-employment tax of $12,240.

Being a self-employed fashion designer might make tax preparation stressful, but with the correct tools and approaches, you can optimize your tax deductions and keep up with your anticipated tax payments.

You may confidently navigate the complicated world of self-employment taxes by maintaining thorough records of your company costs, making contributions to a retirement plan, and working with a tax expert.